3 Key Reports For Business Owners – Xero Features Explored

Xero is not only there to make your bookkeepers lives easier – it can also help you to manage your business.

Lack of understanding of your finances has been identified as one of the top barriers to growth. In the past, business owners either relied on their bookkeepers to run reports to tell them how they were doing, or just looked in the bank to measure their performance.

Xero makes managing a business easier

With Xero, easy access to key business reports allows business owners to keep on top of finances with only a click of a few buttons.Where are the reports?

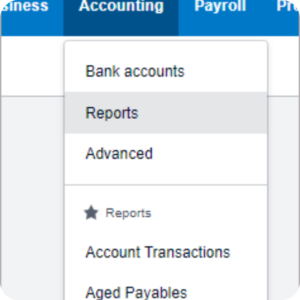

To access the reports, click on Accounting >>>>> Reports

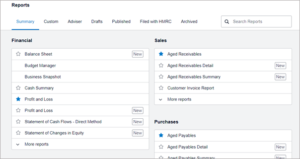

This brings up the full report menu:

By clicking on the star next to the report you can highlight that report as a favourite for later use.

The 3 key reports you are going to want to favourite are:

• Profit and Loss (please note – not the one with NEW next to it)

• Aged Receivables

• Aged Payables

We will now look at these in more detail and identify how the report can benefit your business and how often you should be running them:

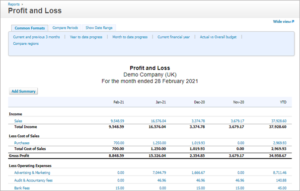

1.Profit and Loss

As soon as it is run, this report will give you a 4-month snapshot of the business and its profitability.

It will show you the business’s:

• Sales

• Costs of Sales

• Gross Profit

• Overheads

• Net Profit

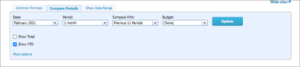

The report can be adjusted to up to 12-months here:

You can drill into any item on this report and find the underlying invoice.

Why is this report important?

We are in the business of making profit. Without profit the business isn’t working and this report will tell you how much profit you are making.

How often should I run it?

You can run this report as often as you like to keep an eye on things, but I recommend at least once a week.

Is the report accurate?

There are some key things that need to be accounted for to make this an accurate report, for example depreciation. As your accountant, we can help you do this.

How else can I use this report?

We like to export the report into Excel and then use it as a basis for some forecasting to see where we will be in the next 3 months.

Or by clicking on Actuals Vs Overall Budget, you can see a snapshot of how you are doing against budget. Contact us if you need help with setting a budget.

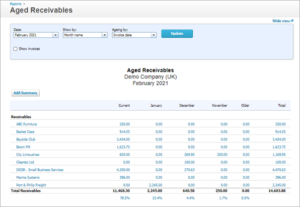

2.Aged Receivables

This report will show you who owes you money and how long they have owed it. There should be no, or very few, negative figures on this report.

By clicking on ‘show invoices’ and ‘update’ you can see each individual invoice.

Why is this report important?

Many a business has failed because they do the work but don’t chase payment. Consider city limousines above – they owe £250 from November, but have just completed a £650 piece of work for them.

If the customer isn’t paying us, then they are not worth doing business with. This report will show you who your late payers are.

How often should I run it?

I recommend running this report each week to keep an eye on it. Then once a month, I use this report to undertake my credit control.

Is the report accurate?

Be aware that you must have reconciled the bank before running this report otherwise you may chase for money that isn’t owed to you.

How else can I use this report?

This report can be used to:

1. See if you need to ask a customer for money before they place an order

2. Use as a basis of credit control

3. Make sure that debts are not going bad

4. To get an overall feeling for the money you are owed.

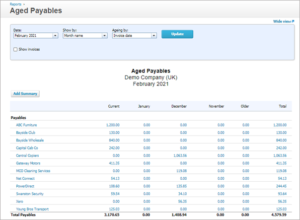

3.Aged Payables

This report will show you who you owe money to and how long you have owed it. There should be no, or very few, negative figures on this report.

By clicking on ‘show invoices’ and ‘update’ you can see each individual invoice.

Why is this report important?

This report shows all supplier invoices and if they have been paid. Its important to get a feel for the money you owe and compare this to the cash you have and what you are owed, to see if you have enough cash to cover your debts.

How often should I run it?

I recommend running this report each week to keep an eye on it.

Is the report accurate?

Be aware that you must have reconciled the bank before running this report otherwise this report may show invoices that have already been paid.

How else can I use this report?

This report can be used for:

• Spotting when an invoice has been duplicated.

• To make sure you haven’t missed any payments (Late supplier payments can affect your credit rating)

• To get an overall feel of the money you owe.

Conclusion

With these 3 key reports you can get a snapshot of your business’s financial position. You can see what you are owed, what you owe and your profitability.

They do need to be accurate, so good bookkeeping practices need to be in place for you to rely on them. If you feel your bookkeeping could be better or is in need of some improvement, then please get in contact.