Credit Cards

Credit cards are exactly the same as Petty Cash.

When you pay off the credit card transfer the cash form the main account to he credit card account then use a manual spend money transaction for all the things bought using the credit card.

CIS

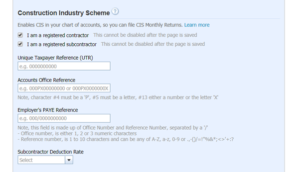

Firstly, turn this feature on by navigating to:

ACCOUNTING >>>> ADVANCE ACCOUNTING >>>> FINANCIAL SETTINGS

And enter the relevant references

If you are a both a contractor and a subcontractor tick both boxes.

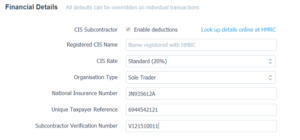

Now set up your subcontractors on Xero – either find them or add them

CONTACTS >>>> FIND CONTACT >>>>> EDIT

Ensure you add all the following details:

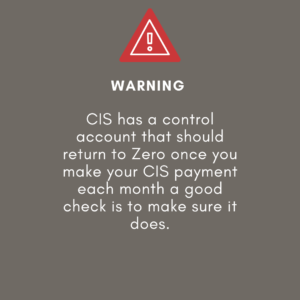

Subcontractors will now appear in a separate group on your Xero contact index.

Now when you enter an invoice for this subcontractor you will enter it to the CIS labour Expense code (321) splitting out any materials on the invoice.

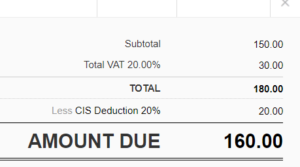

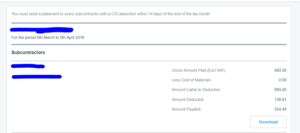

Xero will calculate the CIS due to be deducted:

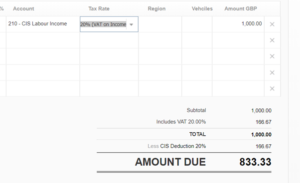

When you raise a sales invoice, you post the labour element of that invoice to CIS labour income account code – Xero then sets aside the amount that will be deducted from you.

Filing the return

Each month a CIS return needs to be filed with HMRC to run the report go to:

ACCOUNTING >>> REPORTS

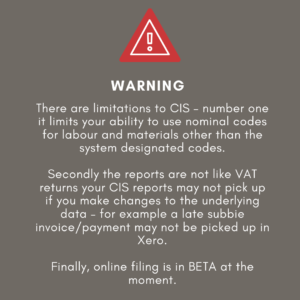

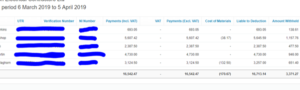

You have two options run the CIS Monthly Report just to look at and check CIS

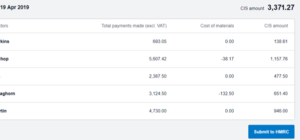

Or to file the return [currently in BETA] to do this run the CIS moth return and online filing from here you can check and file the return with HMRC

Finally, you can run statements for your subbies from reports: