Getting bank info in

Because Xero uses the bank as the centre of finances we need to get the information into Xero more regularly than you used to under the sage system.

There are 2 ways to get the bank information into Xero:

- A Bank feed

- Importing

What you must never be tempted to do is post the bank information manually.

Bank Feed

This is either achieved by logging into your online bank via Xero to establish the link or by a direct link which you pay for.

The paid for link is 100% reliable the other option sometimes breaks and need refreshing

Importing

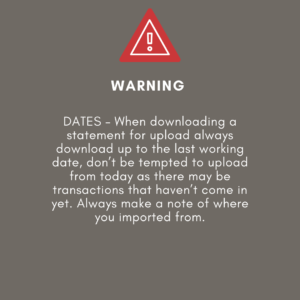

Importing is the process of getting a file from your online bank periodically and importing it.

The best file type is either a Microsoft Money File .ofx or a .csv the .ofx is the preferred method.

You just have to ensure you have the correct date range when exporting from your online bank

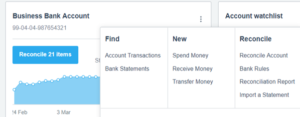

To import go to Dashboard >>>> (THREE DOTS) >>> Import a statement

Reconciling the Bank

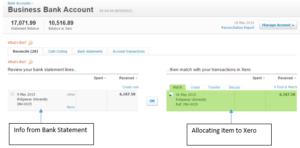

Reconciling the bank in Xero is basically telling Xero what to do with every line of your bank statement.

This is what you will be confronted with when you go to reconcile on the bank:

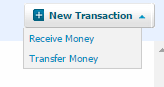

There are only actually three things you can do in Xero with each bank statement line. These are illustrated here:

Match – Match the bank statement line against an existing invoice or unreconciled item (created by a manual payment or receipt)

Create – Posting a payment or receipt where there is no invoice. Such as purchases not on credit and bank charges etc.

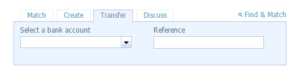

Transfer – Transfer between bank accounts or to a credit card

Matching

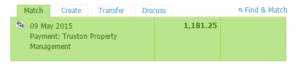

Xero can and will automatically match receipts into the bank against existing invoices.

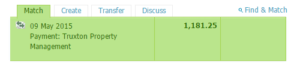

If it does this the item in the bank reconciliation will be green.

In actual fact this one is a match against a manual payment but it looks very similar to Xero when an invoice is matched.

Occasionally Xero will struggle to match where:

- There is more than one invoice for the same amount

- Your customer has paid more than one invoice or you have paid a supplier for more than one.

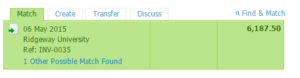

Where there is more than one invoice will see this:

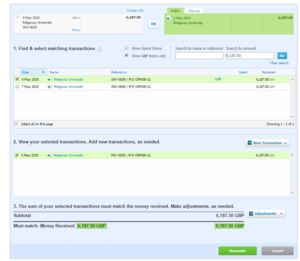

We need to tell Xero which invoice is relates to – click on the words 1 Other Possible Match or Find & Match and you will see this:

This lets you select which invoice or invoice this relates to.

In an ideal world you can just select the correct invoice and click reconcile. If you do that the item will disappear from the reconciliation screen and you will now have 27 items to clear and the difference between the Xero balance and the statement will reduce.

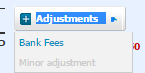

However often there are adjustments to put through – you can do that by clicking here:

This is used for larger items where someone has overpaid or pre-paid.

Or here

This is where you would but minor items such as bank fees. This is used for example where someone pay you after deducting there fee for example some merchant accounts will do this send you only the net amount of the invoice. An example of this is Amazon where they pay net of their fees.

Split Payments

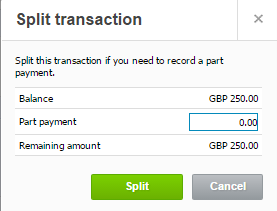

Occasionally you will only receive or pay a part of the invoice for example £500 off of a £1000 invoice.

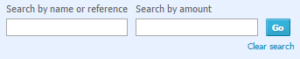

To process this you will need to click Find & Match find the invoice by searching by name or amount in this box:

Select the invoice and click this button:

You can then allocate the money you have received or paid to this invoice:

When you have selected split and then click reconcile this will reduce the amount show on the invoice.

If you operate on CIS this is how you show your part payment of a supplier or customer invoice and then you pay the rest off manually using a CIS account. (But more about that later)

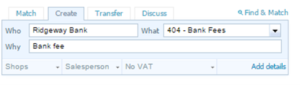

Creating

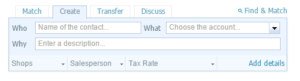

This is where we tell Xero what to do with an item and would be used where there is no invoice posted as is the case where there is no delay between receiving the invoice and paying it e.g. sale or purchase is not on credit.

This actually has all the same details as a bill:

Contact

Account

Description

Tracking

VAT Rate

You would only use this where the payment is going wholly to one account. As in the bank charge above.

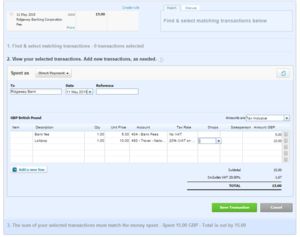

If you wanted to add more detail to a create transaction, for example if you paid for two wildly different items on the same receipt or if one time had VAT and ne didn’t, you would need to click Add details. You will then see this screen:

Your item would then be allocated to two separate accounts and vat would be accounted for separately.

Click Save and Reconcile or OK to reconcile.