Is It Time For You To Go Limited?

Trading as a sole trader or partnership does have some advantages, mainly around flexibility, but the one area where these legal entities can be inefficient is tax.

A limited company, when all things are considered, is a more tax-efficient structure but it does come with some caveats.

This factsheet is all about whether trading as a Limited Company is better for you.What this blog can’t do is look at your individual circumstances, so if you’re thinking of going limited get in touch to review if you would be better off.

Let’s deal with the tax first

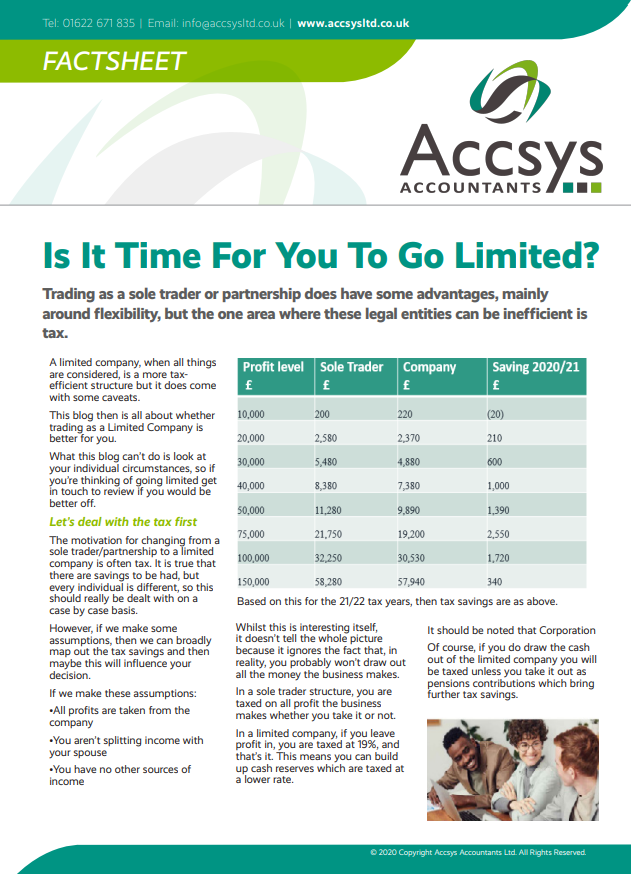

The motivation for changing from a sole trader/partnership to a limited company is often tax. It is true that there are savings to be had, but every individual is different, so this should really be dealt with on a case by case basis.

However, if we make some assumptions, then we can broadly map out the tax savings and then maybe this will influence your decision.

If we make these assumptions:

•All profits are taken from the company

•You aren’t splitting income with your spouse

•You have no other sources of income

Whilst this is interesting itself, it doesn’t tell the whole picture because it ignores the fact that, in reality, you probably won’t draw out all the money the business makes.In a sole trader structure, you are taxed on all profit the business makes whether you take it or not.In a limited company, if you leave profit in, you are taxed at 19%, and that’s it. This means you can build up cash reserves which are taxed at a lower rate.

It should be noted that Corporation Tax is set to rise to 25% from 1st April 2023.Of course, if you do draw the cash out of the limited company you will be taxed unless you take it out as pensions contributions which bring further tax savings.

How do I get paid from a limited company?

If the business is profitable, then the most tax-efficient way of paying your self is a small salary and a dividend. This small salary is paid at the point just below the national insurance threshold – current £737 a month and the rest of your money is taken at a dividend which has the advantage of a £2,000 tax-free allowance and then being taxed at just 7.5% up to the basic rate of tax.

This means you can pay your self-up to £50,270 and pay only £2,677 tax personally. Bear in mind the company would have paid Corporation Tax on the money before you can draw it.So, there are savings to be had for sure, but as mentioned, there are a whole heap of variables to consider before going limited. Such as:

Do you have the self-control to be limited?

A limited company needs a much higher level of record keeping than a sole trader or partnership. Plus, you need to be aware that the company’s money is not yours – you can’t just access the money in the account without tax consequences.

Do you understand the intricacies?

A limited company has numerous additional admin and compliance burdens, for example, you need to file a confirmation statement and accounts at company’s house, a corporation tax return, produce records to justify your dividends.As Accountants, we can help with a lot of this but ultimately, as director you are responsible.

Directors Duties and Limited Liability

As a director, you are responsible for the company and in safeguarding its assets. The company may have limited liability, but you will be held responsible if you act negligently. For example, Corporate manslaughter means you can be held responsible for deaths caused by negligence of the company.

The Advantages and Disadvantages of a Limited Company

Advantages

1.Limited Liability – despite the above, you do have limited financial liability unless you borrow against your personal assets (such as the family home via a personal guarantee) you should be safe.

2.Perception of size – if you have corporate customers, they will expect you to be limited – your business may be perceived to be bigger than it is, which can help.

3.Brand protection – you can prevent anyone else using your name on their company – something you can’t do as a sole trader.

4.Tax Planning – companies can have multiple shareholders and directors, so you and your spouse can take advantage of £2,000 tax free dividends and pension contributions.

5.There are tax savings to be had when you move from a sole trader/partnership to a limited company.

Disadvantages

1.Accounting and administration are more complex and more costly.

2.Multiple shareholders can lead to disagreement, so a shareholder’s agreement is recommended. This will mean costly legal fees.

3.Certain Information is Public, so some of your financials are open to inquisitive members of the public.

4.Easy to set up – difficult to get out of – setting up a company is relatively easy shutting down one is not – it can be costly in terms of tax and fees.

5.Tax planning only works if there is profit in the business a loss-making limited company cannot pay dividends and losses are trapped in the company. A sole trader can use losses against total income.

6.There are costs to incorporating a sole trader business.

So, should I go Limited?

The answer is it depends – it depends on your individual circumstances, but all pro’s and cons need to be considered before making the switch.

If you are considering going limited email will@woolmerkennedy.co.uk or call on 01634 406 166 to discuss how we can help.