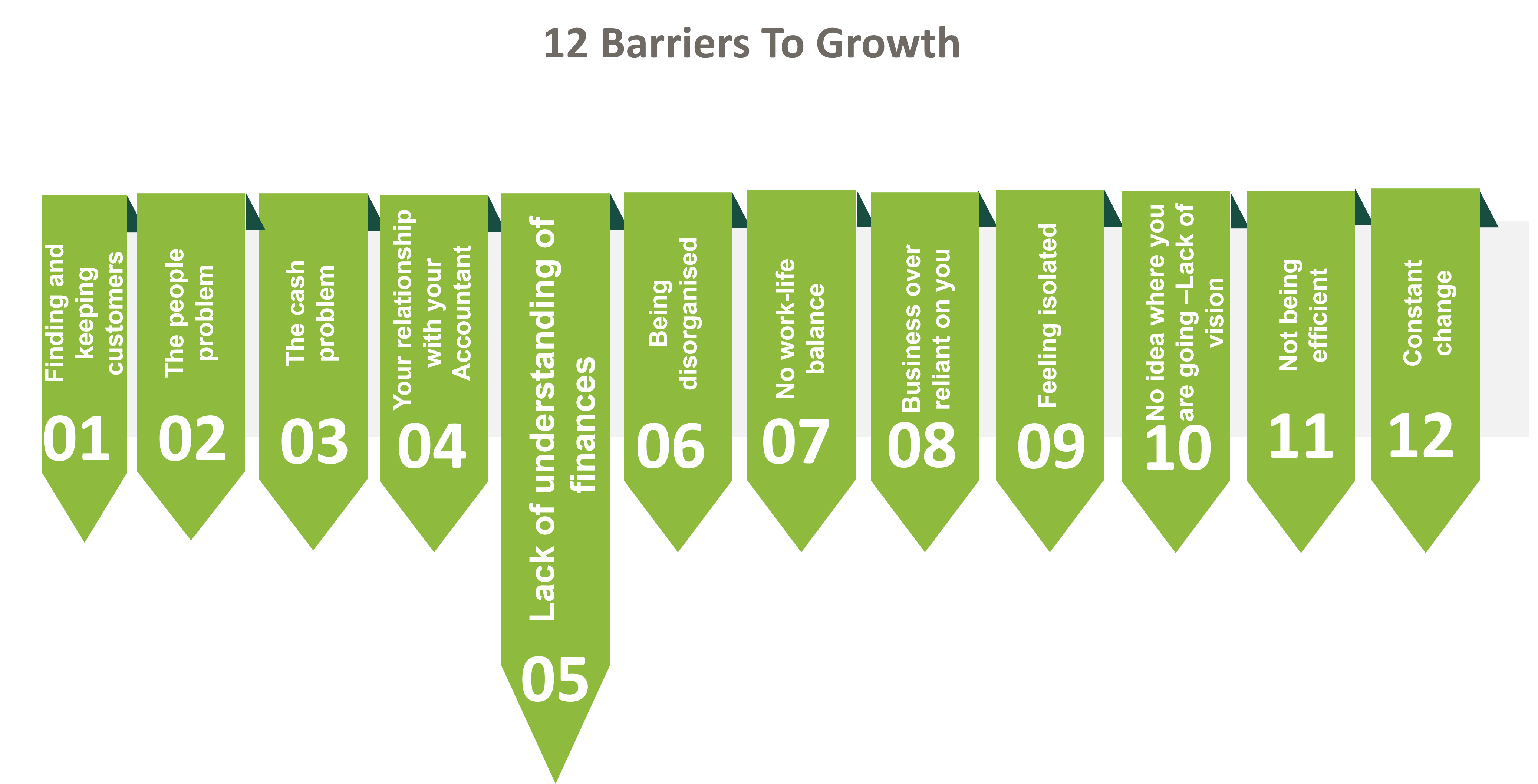

Lack of Understanding OF Finances

Most business owners are motivated to run a business because of the money. They want to provide for their families, build a better life and put away something for their retirement.

The businesses finances are key to everything; the numbers need to add up to make it work. The problem arises when the numbers don’t seem to work.

You may be working hard, but you can’t seem to make the business profitable. This can be compounded by the fact that the majority of business owners don’t understand their numbers. This may lead to a situation where your business should be viable, but it’s not, and you don’t know what to do about it.

The ultimate conclusion to this may be your business failing which has a knock-on effect to you personally as well as professionally, and I don’t need to paint that picture… I’m sure you can see it already.

So how do you avoid this scenario and begin to understand your finances?

Step 1. You need to do is find an accountant you can talk to and who doesn’t bore you to tears or patronise you. Most accountants love talking about the numbers and are willing to share so if you get a good one, then that’s a great start.

Step 2. Change your mind-set about the numbers and learn to embrace them. They will tell you a lot about your business, don’t be scared of them – be inquisitive of them. Every successful business owner bar none has done this, so you will need to.

Step 3. Ask your friendly accountant for a monthly finance meeting to discuss your accounts and ask them to help you prepare management accounts.

Management accounts are a period profit and loss showing your businesses financial performance

Step 4. Use a product such as Xero or Quickbooks online that makes the keeping of books and producing financial report so much easier.

Step 5. Make decisions based on your numbers When you have accurate numbers, and you can understand them, you can start making your decisions based on the numbers rather than your gut feeling whether it be about buying a new piece of equipment, employing a new member of staff or identifying where you can cut costs.

The numbers in your business will help you plan. You should also think about setting a budget for your business, plotting out what you are likely to spend and then you should track the actual spend vs the budget.

Most business owners are motivated to run a business because of the money. They want to provide for their families, build a better life and put away something for their retirement.

The businesses finances are key to everything; the numbers need to add up to make it work. The problem arises when the numbers don’t seem to work.

You may be working hard, but you can’t seem to make the business profitable. This can be compounded by the fact that the majority of business owners don’t understand their numbers. This may lead to a situation where your business should be viable, but it’s not, and you don’t know what to do about it.

The ultimate conclusion to this may be your business failing which has a knock-on effect to you personally as well as professionally, and I don’t need to paint that picture… I’m sure you can see it already.

So how do you avoid this scenario and begin to understand your finances?

Step 1. You need to do is find an accountant you can talk to and who doesn’t bore you to tears or patronise you. Most accountants love talking about the numbers and are willing to share so if you get a good one, then that’s a great start.

Step 2. Change your mind-set about the numbers and learn to embrace them. They will tell you a lot about your business, don’t be scared of them – be inquisitive of them. Every successful business owner bar none has done this, so you will need to.

Step 3. Ask your friendly accountant for a monthly finance meeting to discuss your accounts and ask them to help you prepare management accounts.

Management accounts are a period profit and loss showing your businesses financial performance

Step 4. Use a product such as Xero or Quickbooks online that makes the keeping of books and producing financial report so much easier.

Step 5. Make decisions based on your numbers When you have accurate numbers, and you can understand them, you can start making your decisions based on the numbers rather than your gut feeling whether it be about buying a new piece of equipment, employing a new member of staff or identifying where you can cut costs.

The numbers in your business will help you plan. You should also think about setting a budget for your business, plotting out what you are likely to spend and then you should track the actual spend vs the budget.