Should I have a holding company

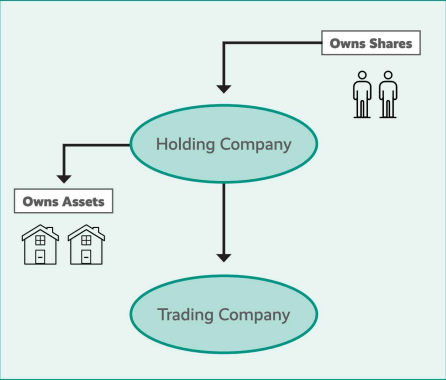

A holding company is another limited company that owns the shares in your trading company. This creates a group of companies ultimately owned by you, which can have some advantages for small businesses and their owners.

The advantages come because certain assets owned by the holding company are ring-fenced and protected from something going wrong with the trading company.

For example, the following can be protected with a holding company structure:

•Fixed assets such as plant and machinery

•Property (commercial and/or residential)

•Intellectual property, patents and trademarks

•Cash

More than one Trading Company

You can also use a holding company if you want to diversify your trade but are worried the new trade is too risky. A new company can be set up, owned by the holding company, to undertake this trade without disrupting the main company.

Each trading company would be ring-fenced, and if things go wrong, could be liquidated without affecting the other companies.If one of the companies is loss making, you can even use the losses in the other companies by claiming group relief.

Selling the trading business

You may be considering selling your trading business but want to keep the assets.

Let’s say you had a trading company that owned its own premises and you want to sell the trading company but retain the property.

If structured correctly, and subject to clearance from HMRC, you can do this with:

•No Stamp Duty Land Tax payable on the transfer of property.

•No income tax, capital gains tax or corporation tax payable on the restructuring of the companies.

•A ‘clean’ trading company that is more attractive to purchasers.

•Entrepreneurs’ relief (10% capital gains tax) on sale of trading business*

•A rental stream paid by the trading company to the property company for the use of trading premises.

•Legal separation of the property away from any risk of a downturn in trade.

*Entrepreneurs relief is possible in a holding company structure but will require additional steps and clearance from HMRC. It is important to seek advice before making decisions on whether a holding company is correct for your circumstances.

How do I get cash into my holding company?

You can protect cash from your trading company by paying a dividend from your trading company to the holding company.

Dividends between companies that are 100% owned are tax-free.

Beware the trap of a holding company owning two trading companies

If you sell your trading company, you should qualify for entrepreneur’s relief at 10%. If you have a holding company, you should still qualify for this unless your holding company has significant investment assets (greater than 20% of overall assets) not used for the purposes of the trade. The rental property your business uses does not count, but if you use the holding company for other business or have built up large cash reserves, then this could be an issue.

Talk to us

If you are considering a holding company to protect your assets, then give us a call we will be happy to discuss it.