The Benefit of Budgeting – Xero Features Explored

Xero has some great features, that are included in the fee you pay, but are not often used as they are not part of the core product and are often overlooked.

The Budgeting Manager is one such feature. Budgeting itself is important if you want to keep some financial control over your business.

What is budgeting?

It’s important to spend within the means of your business to maintain profitability, and budgeting can help you do this.

Budgeting is simply setting a target, or anticipated amount of money, against your sales, costs of sales and overheads. By doing this, you can track what you are actually spending or receiving against what you anticipated that you might spend or receive.

The reason small businesses avoid setting a budget is because, in the past, it was difficult and time consuming to do without a major pay off. The priority for small businesses is to sell and deliver goods and get paid. Budgeting is low down on the list of priorities.

However, Xero have made the process quick and easy, so there really is no excuse not to set a budget and then track how you are doing against it at the end of each month.

To access budgeting on Xero navigate to:

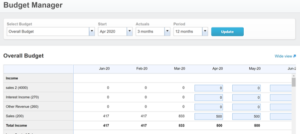

ACCOUNTING >>>>>REPORTS >>>BUDGET MANAGER

This is where you enter your budget. If your year end is December, you will want to change the start date to Jan and if your year end is March, change it to April.

On this screen you can enter your budgeted, or anticipated, income and costs for future months. You only really have to do this for one month as you can copy any detail you enter into subsequent months.

The steps for entering a budget are:

1.Enter the anticipated sales for the first month,

2.Enter the anticipated cost of sales,

3.Enter the anticipated over heads.

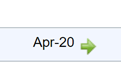

Roll forward the whole budget by clicking where you see this:

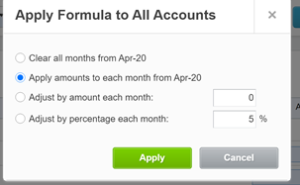

You are now presented with the following options:

Select the option to ‘apply amounts to each month from Month-Year’ in this case, April-20.

This will roll forward your whole budget.

Now look at individual items and check the budget looks ok for these – you can tweak any that may be due to increase or decrease, for example you can increase staff costs if you are planning to hire someone.

You can export the whole budget to Excel if you want to get a better look at it.

Your Monthly Budget Review

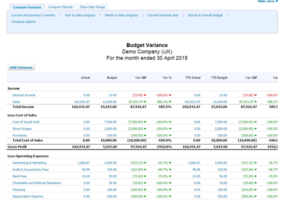

Now you have set a Budget you should run the Budget Variance report once a month. It compares your actual profit and loss with your budgeted profit and loss.

ACCOUNTING >>>>> REPORTS >>>>> BUDGET VARIANCE

If you keep your budgeted Profit and Loss up to date, then you will be able to use this report to keep track of income and expenditures.

For example, by running this report we can see that that we incurred a £1,000 insurance cost we hadn’t anticipated, which could be a prepayment that we haven’t accounted for:

Budgeting what’s the point?

One of the top ten reasons businesses fail is a lack of financial control. Budgeting is another tool in your tool belt to give you financial control of your business.

If you keep an eye on what you are spending, you won’t be surprised when you make a profit or loss.

If you would like some training on Xero’s budgeting tool contact us.