Aged between 45-70? Check your state pension record now.

This article does not constitute financial advice, please take independent advice on pensions before making financial decisions.

Pension rules are changing and if you are aged between 45-70 you have a limited time period to make sure you will qualify for the full new state pension.

This guide explains how you could potentially turn £824, invested now, into an additional £6,057 in retirement income.

As of the 12th of June 2023, the deadline has now been extended to April 2025.

This added 2 years gives people more time to properly consider whether paying voluntary contributions is right for them.

To qualify for a full state pension, you need to have 35 qualifying years (if you have less than this but more than 10, you will get a proportion of the full state pension.)

You get a qualifying year by earning above the lower earnings limit or making a voluntary national insurance contribution (Topping Up)

Until the 5th of April 2025, you can go back to 2006 to make these top-ups but after that deadline, you can only go back 6 years.

So why is topping up your state pension important?

Each qualifying year you add to your state pension by topping up will give you around £302 a year pension income and the cost to you of topping up that year will be around £824.

Let’s assume you live for 14 years after the age of 66 (the average life expectancy of a UK man is 80.) The £302 extra you will get by topping up and adding a single year of pension entitlement will be worth £4,228 over this time period (£302 x 14)

So, for a £842 investment now you get £4,228 extra on your pension (which is a 20% Return on investment)

Plus pensions will go up with inflation so this might be more.

So how do you work out if you need to do this?

Firstly, set up your personal tax account here.

Then scroll to the bottom and click on ‘View State Pension Forecast.’

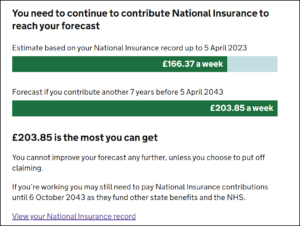

This is the forecast for mine – I am on track for £203.85 a week if I contribute another 7 years.

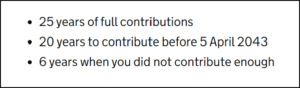

To check your NI record, click the link on your personal tax account – ‘View Your National Insurance Record’, and you will see a statement like this:

I have 6 years where I didn’t contribute enough, but I have 20 years to contribute the missing 7 years that I need to qualify for the full state pension.

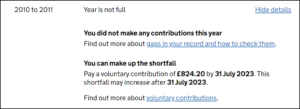

My record does show that back in 2010 I didn’t have a full year and up until the 1st of August, I can add a top to make this year a qualifying one but after the 1st of August I will only be able to go back 6 years. So, I will lose the opportunity to top this year up.

Your forecast should also tell you the amount it would cost you to top up and make a particular year count towards your entitlement, the maximum is £824.

Should you top up?

Only top up if you are likely not to be able to work long enough to make the contributions needed.

For example, I have 20 years to make up 7 years of missed contributions so it wouldn’t be worth me topping up as I am probably going to be working for at least another seven years (unless I win the lottery)

However, if, for example, you are 60 and will retire in 5 years and you have 10 years to make up, it would be important to top these up before the 5th of April 2025. After April 2025, you will only be able to make up 6 years.

As stated, we cannot give financial advice so if you are worried about this we recommend speaking to an Independent Financial Adviser.

Where to go next:

- Contact a financial adviser.

- Read the Money-saving guide to making contributions.

- Call the pension helpline.