HMRC do not like entertaining as much as the rest of us – at least they don’t like to give us tax relief for spending money on it.

There are several areas that confuse people about what they can and can’t spend on Entertaining.

Firstly, broadly speaking, there are two types of entertaining employee and third party (customers/supplier) entertainment.

Then there are three taxes coming into play:

- Corporation Tax

- VAT

- Employee Benefits.

Employee Entertainment

This can be broken down into two categories:

- Events – The Annual Party

- Food provided during the year

The Annual Event

Each employee and their partners have an annual limit of £150 for being entertained over the course of a year.

The £150 includes VAT and includes any extra costs you pay for such as travel/accommodation.

If the cost exceeds more than £150 per head, the amount becomes a benefit in kind to the employee.

All staff must be invited to the event.

Provided the £150 limit is not exceeded, there can be any number of parties, for instance, 3 parties at the cost of £50 each – at various times of the year.

Employees where you don’t need to class them as “entertainment” are:

- Pensioners and Ex-Employees

- Job Applicants and interviewees

- Shareholders (who are not employed by the company)

Corporation Tax Treatment

The cost of the events is allowable for Corporation Tax.

VAT Treatment

The VAT can be reclaimed as long as you are not just inviting directors and clients are not invited. If clients are invited, some of the VAT will be blocked.

Employee Benefits

If the cost of the event exceeds £150 in any 12-month period, then the amount spend creates a taxable benefit in kind on the employees but this can be paid for by the employer by using a PAYE settlement agreement (you then pay your employees’ tax and NICs)

Employee Food Provided during the year

You can provide Tea, coffee and biscuits to everyone in your office as long as you don’t exclude anyone from this.

Workplace canteens are exempt from tax if they are provided to all.

Taking your team to a restaurant is deductible for corporation tax and vat but you there will be a tax on the individual unless you do a PAYE settlement agreement.

If food is provided as part of a business conference or meeting and the main focus of the meeting is not food, then there is no tax payable.

Client/Supplier Entertainment (E.g. anyone who is not an employee)

You can use the company’s money to pay for entertaining clients and suppliers, but any form of hospitality is not tax allowable for either Corporation Tax or VAT.

This includes:

- Provision of food and drink

- Provision of accommodation (such as in hotels)

- Provision of theatre and concert tickets

- Entry to sporting events and facilities

- Entry to clubs and nightclubs

- Use of capital assets such as yachts and aircraft for the purpose of entertaining

The only exceptions are:

You are holding a business meeting in the office and provide soft drinks and light food such as sandwiches for the meeting not to be interrupted.

If you hold a meeting outside of the office, because there is no other alternative, then you can provide the same – soft drinks/basic food.

Once you finish your business meeting – if you continue to provide hospitality, then this part becomes disallowable.

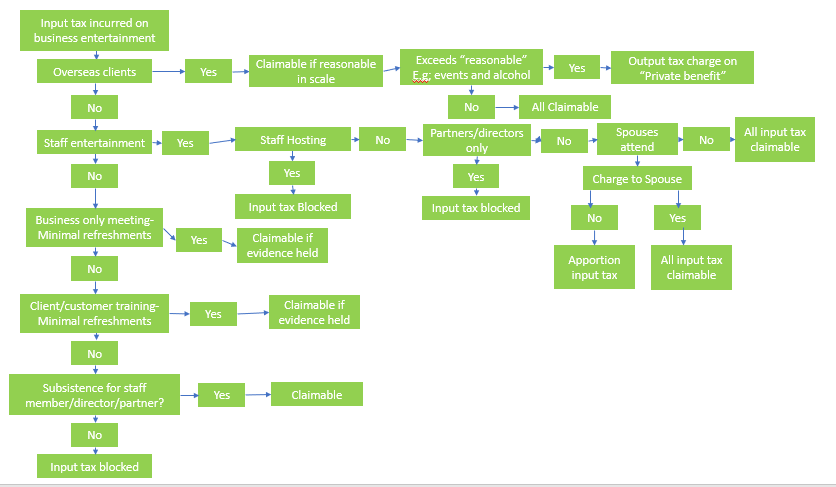

Since VAT is a minefield, we have included a flowchart below to guide you through this area: