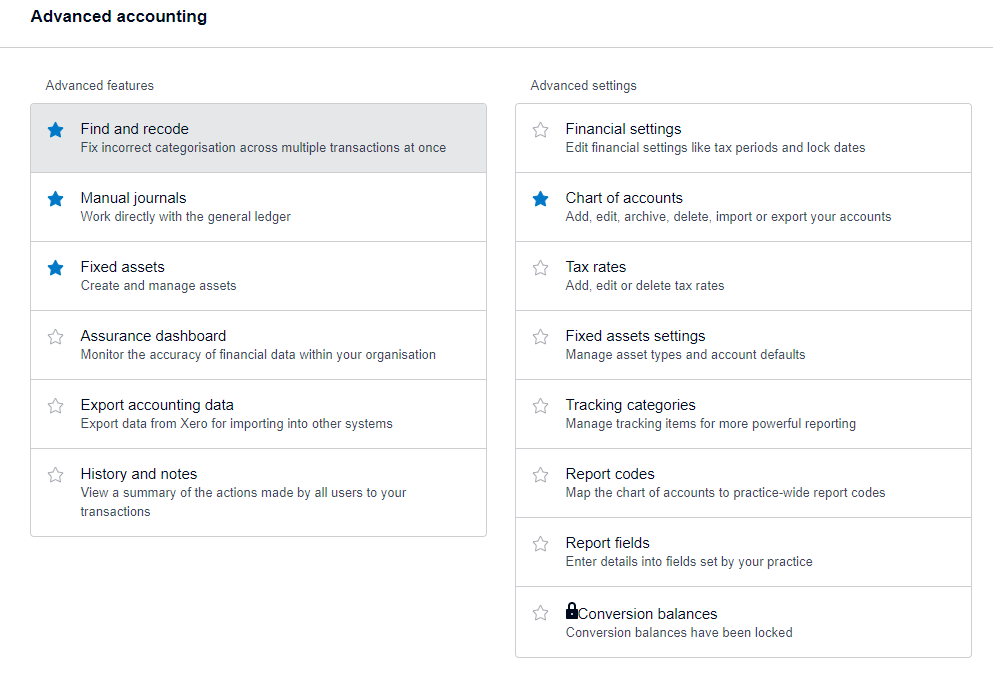

4. Advanced Settings -Accounting Advanced

Accounting >>>> Settings

This is where you access and modify Xero’s Advanced settings.

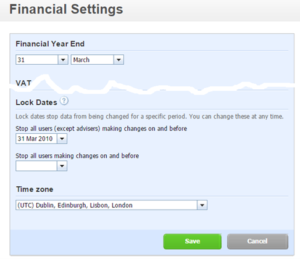

Financial Settings

This is where you set some important financial settings. There is generally no need to touch these but one feature you may use, especially in multi-user environments, is the ability to lock dates. This prevents users from going back and changing things. This can be easily undone but is a good fail save.

There is no month-end process in Xero so this is the closest you will get to closing down a period.

Chart of Accounts

Access this by going to Advanced >>> Chart of Account

The chart of account is a list of all the Accounts held in Xero.

Accounts are where you allocate items to (Invoices, Journals, etc.). So for example when you post a sales invoice you put it to a sales Account code and when you post a fuel receipt you put it to an overhead Account code.

Important Learning Point: It’s important to understand the different types of Account code.

| Revenue | Sales and Other Income |

|---|---|

| Expenses | Overheads, Cost of Sales |

| Assets | Things the business owns |

| Liabilities | Things the business owes |

| Equity | Retained PRofits & Shares |

There are two main reports in any set of accounts:

The Profit and Loss

- Sales

- Less Cost of Sales

- Variable Cost – Direct Costs

- Gross Profit

- Overheads

- Fixed Costs – Overheads

- Net Profit

Balance Sheet

- Fixed Assets

- Plant

- Fixtures

- Computers

- Current Assets

- Debtors – Receivables

- Bank

- Cash

- Stock

- Current Liabilities

- Loans

- Hire Purchase

- Equity

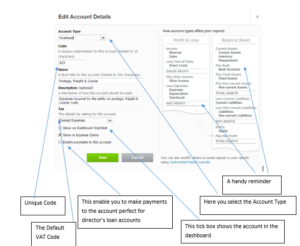

Accounts

There is potential for confusion here as Accounts as well as meaning the accounts for the business as a whole is also the name of the individual place you post items to.

Each account has a bunch of setting that can be adjusted and are access from the chart of accounts.

Other thing you can do in the chart of accounts is add a bank account – this is a separate type of account.

Fixed Asset Settings

Manage asset types and account details

Tax rates

Every transaction line item you enter Xero needs a Tax Rate. This refers to VAT in the UK and generally, this area does not need to be modified.

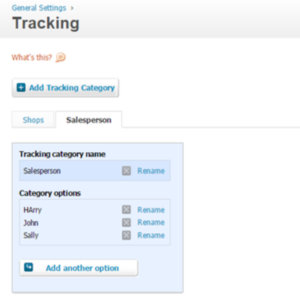

Tracking categories

Tracking is Xero’s Version of Departments.

With them, you can set up upto two department headings with unlimited departments.

Once the tracking headings are set you can allocate every Sales Invoice, Purchase Invoice, Payment, and Receipt to them so that you can start reporting on them

The most powerful feature is that you can run a profit and loss report by these departments.

For example, you could have a number of Vans on the road and a number of Depots.

You could have a profit and loss by Van and by Depot

Another example is you may have a number of Shops and a number of Sales People.

Have a think about how you could use these departments in your business and if in doubt ask your accountant.

Conversion Balances

When you first join Xero you will need to make sure your existing accounts are transferred correctly (unless you are a brand new business).

If you have traded before you started using Xero you will need the help of your accountant to make sure these numbers are correct.

The balances entered here will affect your reporting and the balance on the bank so do need to be accurate.