6. Understanding How Xero deals with Multi Currency

Firstly, you will need Xero’s multi-currency version to start using the multicurrency options. If you don’t operate in a multi-currency environment then you won’t need this and can use Xero standard version and you can move on from this section.

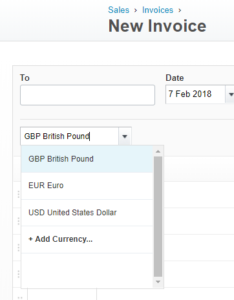

Once you have the upgraded version of Xero and set your currencies, in the setting section, you will start seeing the multi-currency option on things such as sales invoices, bills etc

Each time an invoice, bill or credit note is entered in a foreign currency, gains or losses are recorded on the transaction. This is due to currency movements between the time you entered the transaction and the time payment or refund was made

- Depending on the status of the transaction, the gain or loss will either be realised or unrealised.

- Gains and losses don’t appear on bank account transactions, they are only visible on invoices, bills or credit notes.

- Gain or loss information doesn’t show on unapproved items, items that have been deleted or voided, or items in your base currency.

- Each time you approve an invoice, bill or credit note that is entered in a foreign currency, gains or losses are recorded on the transaction that reflect the exchange rate changing over time.

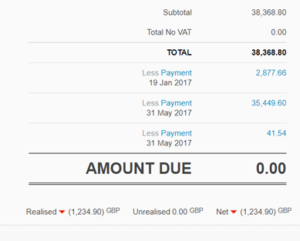

If you make a partial payment or partially refund an invoice, bill or credit note, a gain or loss is calculated using the exchange rate the day the payment was made. The total net gain or loss will be the combined total of these partial payments or refunds.

You can see these Unrealised Gains and Losses at the bottom of each invoice:

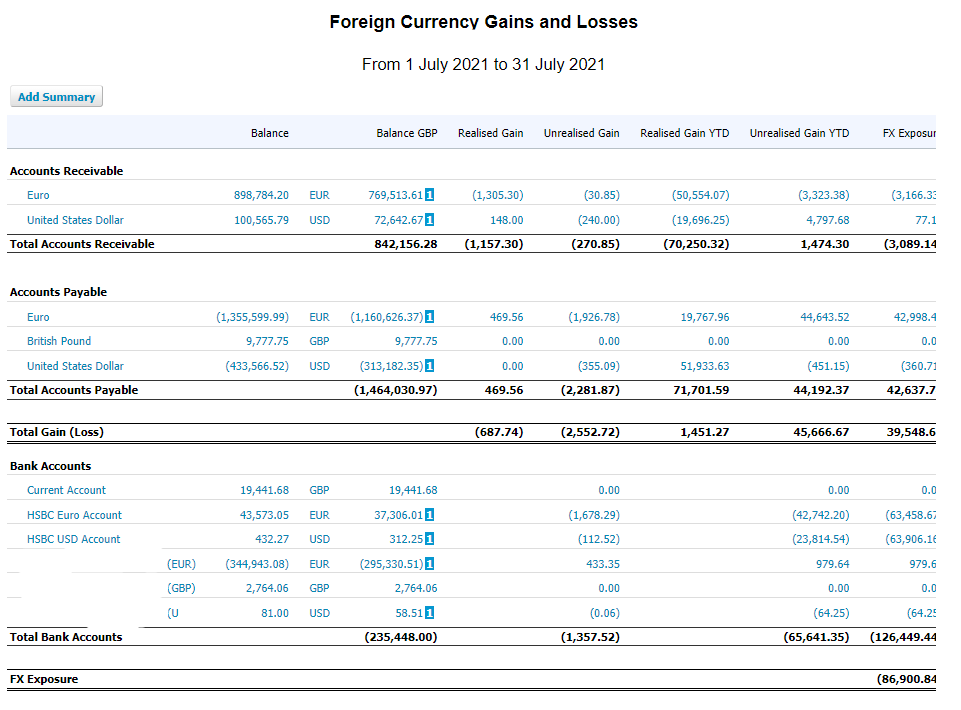

If you run a profit and loss report, you can click on the foreign currency amount listed you can see a report of all these gains and losses.

The chart of accounts has 3 system accounts that keep track of realised and unrealised currency movements. If you are using multi-currency in your organisation, they are included in your chart of accounts by default. If you’ve added a foreign currency bank account, the account and balance will also display.

Bank revaluation account

Any transaction from a foreign currency bank account that has been revalued is automatically coded to this account. Transactions include spend and receive money, bank account transfers, sales invoices, bills and credit note refunds.

Unrealised currency gains account

This account calculates the unrealised gains or losses on unpaid invoices or bills, calculated at today’s exchange rate.

Realised currency gains account

This account calculates the gains or losses recorded between the date that the invoice, bill or credit note was created and the date of payment.