10. Reporting

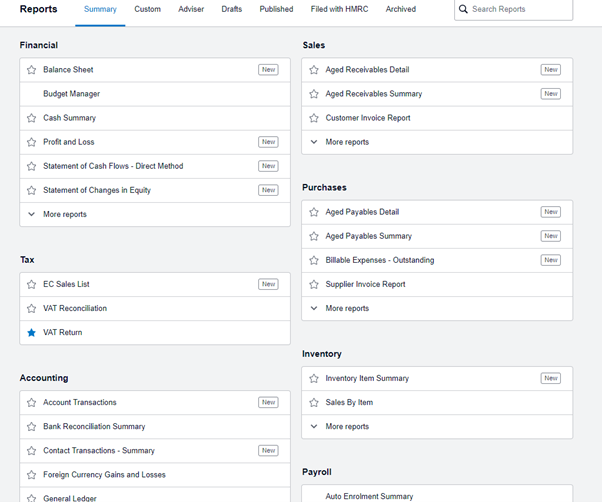

This is the report menu.

I am going to focus on four essential reports:

Profit & Loss

VAT Return

Aged Payables

Receivables

These are essential because they make the biggest impact – the other reports are still worth a look but these are beyond the scope of this course.

If you star the reports in the menu they will appear under the main report menu:

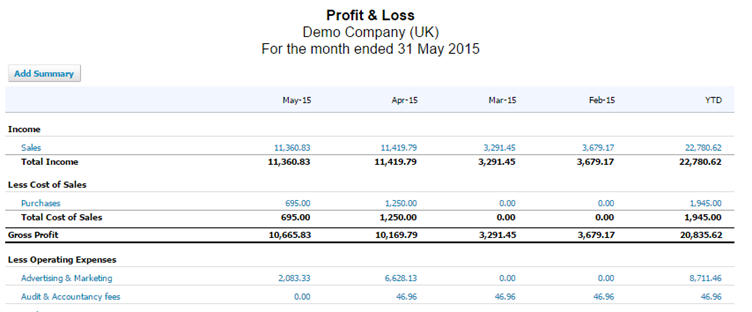

Profit and Loss (OLD)

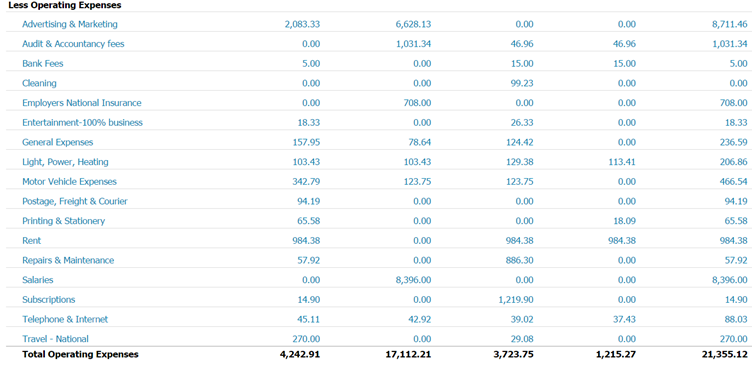

The profit and loss report is just a summary of the accounts you have been posting your invoices to, laid out in the traditional method.

It shows:

- Sales – All the sales you have made

- Cost of Sales – What it cost you to make those sales

- Gross Profit – The Gross Profit (Sales less cost of sales)

- Overheads – The fixed costs of your business

- Net Profit – Net Profit – Gross Profit less Overheads.

This report shows the latest month on the far left of the screen and a number of months in the past to the right.

Anything in blue on this report will, if you click on it, allow you to drill down into the transactional and ultimately to the invoice.

This report is a fantastic tool for checking if you have made errors in your postings.

For example, can you spot an error on this P&L extract?

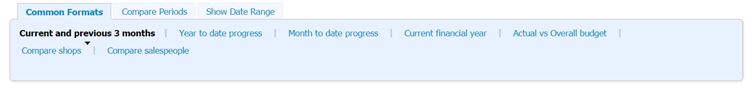

As mentioned there are all sorts of options for this report:

I will focus on three:

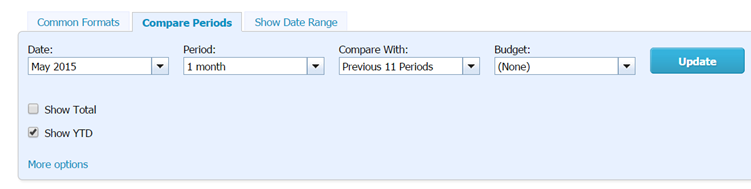

Compare Periods

This allows you to have up to 12 months of P&L side by side. Have a play and see what variations you can run.

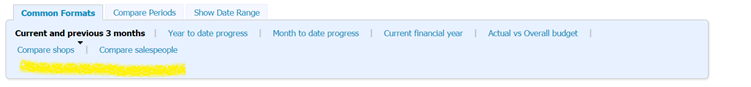

Tracking / Department P&L’s

These two headings – underlined here will run your P&L by your departments. In this case Shops and Salespeople. This allows you to see how profitable each of your departments is.

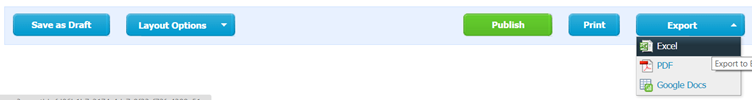

Once you are happy you can easily export these reports at the bottom of the page:

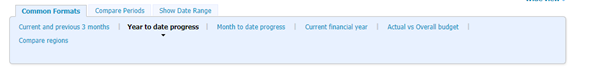

Year to date progress

This report does a direct comparison with the same period last year. Year to date

I recommend clicking on the show date range tab and putting the end date back to the previous months otherwise you will have the latest incomplete month included.

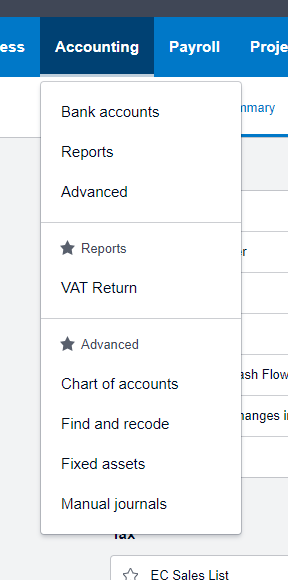

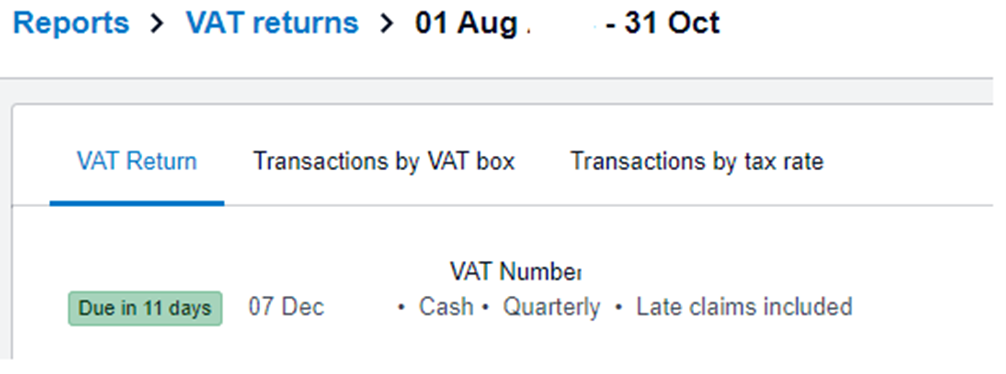

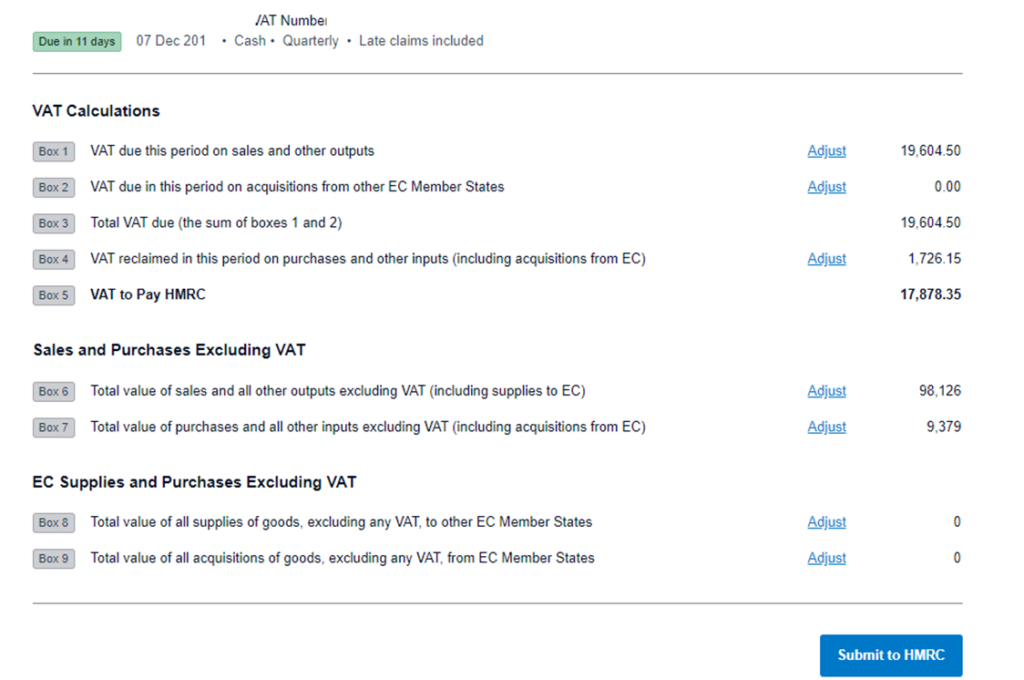

VAT Return

If you aren’t VAT registered, you can skip this section. If you are VAT registered you need to have registered with HMRC for Making Tax Digital separately.

ACCOUNTING >>>> VAT RETURN

This report comes with three tabs:

The return tells you how much you have to pay and the details section tells you how this is made up.

Once you click Submit to HMRC …..You will be asked for your HMRC Log in and Password.

Aged Reports

The two reports in this section are Aged Payables (Money you owe) and Aged Receivables (Money owed to you)

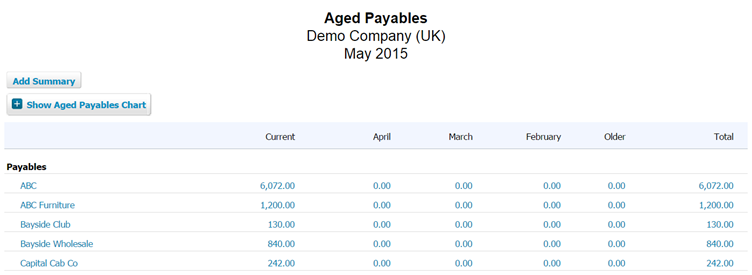

Aged Payables

This report shows everything owed by you and is great for planning who to pay.

The report looks like this:

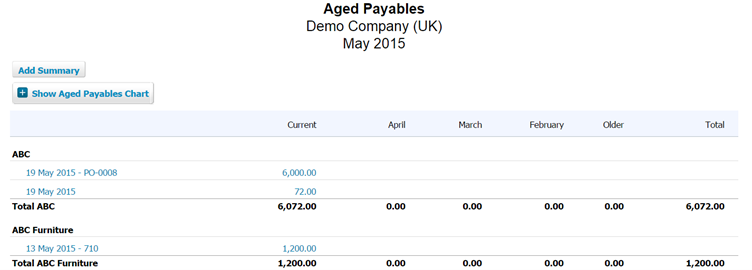

Tick the show invoices button and it looks like this:

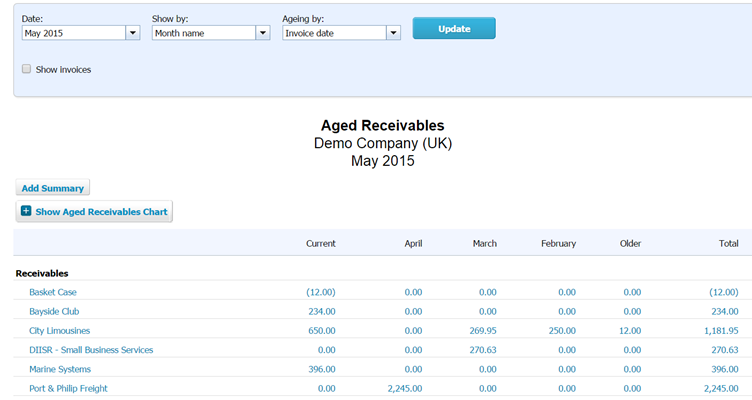

Aged Receivables

This is everything anyone owes by you displayed by age of the invoice.

This report is great for seeing which invoices you owe when doing credit control.

The report looks like this:

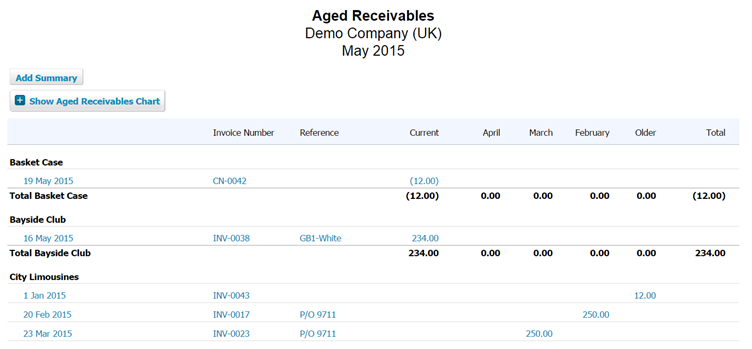

And if you tick the show invoices tick box it looks like this:

Any of these invoices can be drilled into for further investigation.

Sending Customer Statements

To do this we need to navigate to the contacts page for the customer you want to send the statement to.

Personally, I just drill into the invoice on the aged receivables report and then click on their name or you could go to:

CONTACTS >>>> CUSTOMERS

Or search in the universal search button

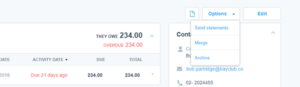

Once you are on the contact page. Click the send statement button:

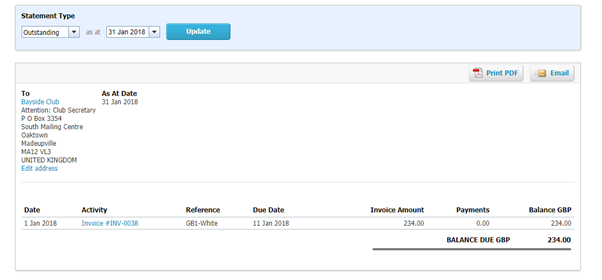

Change statement type to outstanding and click update. The result will look like this:

You can now email or Print the statement.

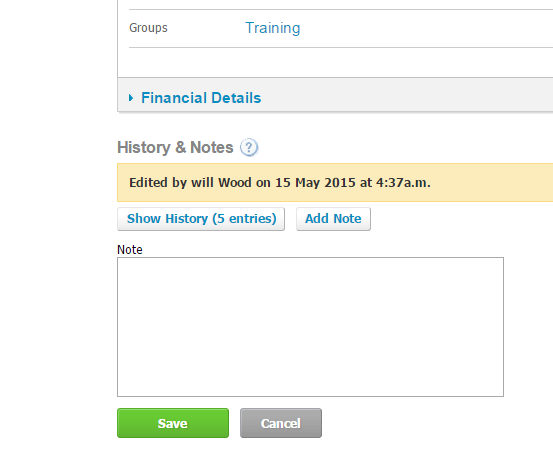

If you want to make a notes about credit control activities you can do this in two places.

- On the main contact page

- Against specific invoices

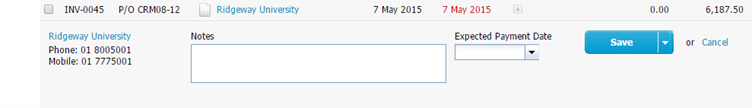

For Specific invoices:

Go to BUSINESS >>>> SALES OVERVIEW >>>>Awaiting payment find the invoices and click on the due date and enter your notes here.

To enter notes on the contact use add note dialogue at the bottom of each contact